Let us ramp up your deal flow!

There are many ways that corporate investor groups source opportunities, and they range from the laughably inefficient to tremendously focused and effective.

At the lower end of these efforts are obvious form letters from obviously junior associates of firms that are obviously fundless sponsors. These attempts are dead on arrival. Equally fruitless are phone calls to the founders or executives of your target companies that seldom make it past the gatekeeper. There are far better ways to find quality investment opportunities.

How much time do you spend traveling, phoning and Googling for opportunities? When you do identify a desirable target, how do you distinguish yourself from the dozens of equally qualified suitors that are probably chasing the same deal? And after you spend thousands of dollars and many man hours, how often do you find that the numbers they initially dangled were bullshit?

We’re at the other end of that spectrum. Let’s talk about how a relationship with Players Capital Group can increase your actionable deal flow. Our origination team is a group of successful former professional athletes. Just like you, we know and understand the Mergers and Acquisitions landscape.

This is our footprint

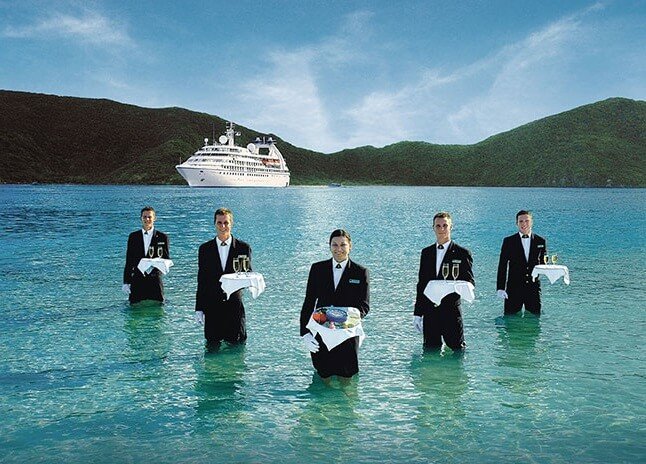

Although you know how to raise money and where to successfully deploy it, you can’t be everywhere. If you have offices in New York, Chicago and LA, you’re still a long way from that foundry in Florida or that distributor in Durham you covet. In the places that are hard for you to get to, we’re probably already there. A relationship with us would provide you with a network of representatives everywhere in the country. Your initial overtures to these companies wouldn’t be from a junior person in your office or a faceless attorney but a highly polished local hero who can entertain the target in style. This is just the beginning of our value proposition.

It’s all about the closing table!

Just like you, we know how to read a P&L and a balance sheet. We understand debt, liquidity and finance. We understand the industry verticals you operate in. We understand that you are looking for a combination of these features and how to identify them:

Cash Flow Dynamics

- Positive EBITDA

- Stability, Predictability and Growth

- Recurring Revenues

Market Positioning

- Sustainable Competitive Edge

- Identifiable and Differentiated Niche

- Meaningful Barriers to Entry

Management and Staff Abilities

- Proven Operators

- Drive and Desire for Growth

- Deep Industry Knowledge

Growth Potential

- Presence in Stable and Growing Markets

- Organic Growth or Add-on Opportunities

- Accessible Growth Avenues

Do you have a steady flow of actionable opportunities?

When the right seller is talking to the right buyer, not much can happen to derail the deal. Deals that are destined to close usually do so quickly and quietly… Do you have a steady flow of actionable opportunities?

Value creation is at the core of our existence, and here is the value in a relationship with us. When we put a deal on your desk, it will be for a company in a vertical you want, that wants to do a deal rather than kick tires, has reasonable price expectations and transparent books with no ticking time bombs. Most importantly, if this is a deal we sourced at your request, you will be the only one looking at it.

What’s in it for us? We want to work with senior partners at aggressive investment groups who know what they want, have done it before and know how to decisively steer a transaction to the closing table. If you have the paralysis of analysis, we’re not for you. If you’re the type of investor that looks at a thousand deals a year and only does one, we’re probably not for you. But If you’re looking for steady quality deal flow, contact one of us and we’ll talk about how our highly targeted and focused systems can help us do great things together for a long time.