When a nationally prominent Mergers and Acquisitions advisory firm invited the CEO of a company we own to a seminar to explain their process for bringing a business to the market we were happy to attend the meeting if for no other reason than to see how our competitors operate. What we saw was a real eye opener.

Let’s back up a bit first. We got into this business many years ago when we cashed out and sold a company we had founded. Soon, we sold a few others and developed relationships with the people we had sold these companies to. They asked us to help them find other companies to invest in and voila! We were in the investment banking business.

Having been involved in several highly competitive industries, we took our experience and attacked the world of Mergers and Acquisitions and investment banking with the same intensity required of us in professional sports. We never even thought to look at what other people in the industry were doing. We just used our common sense and instincts.

When we finally slowed down and took a look at how other M&A firms ran a deal we were shocked. The first thing we realized was how utterly passive they were. If they had a company for sale they would simply post it on their “for sale” section of their website and wait for buyers to find it.

When we looked at that “Companies for Sale” section we were even more surprised. These M&A advisors (who claimed to be the kings of discretion) would create online web profiles of their client’s company. If you liked the general description you could sign a non-disclosure agreement and receive a package of financial information and the name and location of the company. When we Googled the descriptive information in the teaser the client company would invariably come up on the first page, meaning that all they did to package the deal was to copy the verbiage on the client’s website, which basically told the world, including the client’s customers, employees and suppliers that the company was for sale. Not exactly playing from the blue tees. So much for confidentiality.

We were even more surprised to learn that for them to even start this less than rigorous process on your behalf you would have to stroke them a check for somewhere between forty and seventy-five grand. That’s just to get out of bed. Fully earned upon receipt.

They also state that it takes a minimum of nine months to sell a company. If you do business in such a passive manner, maybe. We feel differently. We’ve done plenty in 60-90 days. But if we approached you about a transaction it’s because we already know who wants to buy your company. If you are in an industry that is in demand, we can expedite the process.

We’re not interested in participation trophies. Our competitors make more money in engagement fees than they do in success fees. We invest time, money and energy in deals that we like. If we are offering to put a deal together to solve your capital needs, be it an exit, a majority or minority buyout or a debt raise we believe that you have a winner. We mobilize our considerable resources to get it done.

Although we don’t charge upfront fees, we do require you to put forth the effort to provide us the information we need. If you cannot or will not furnish us what we need in a timely manner, we’ll know you’re not that serious and we’ll remain friends and wait until you are ready.

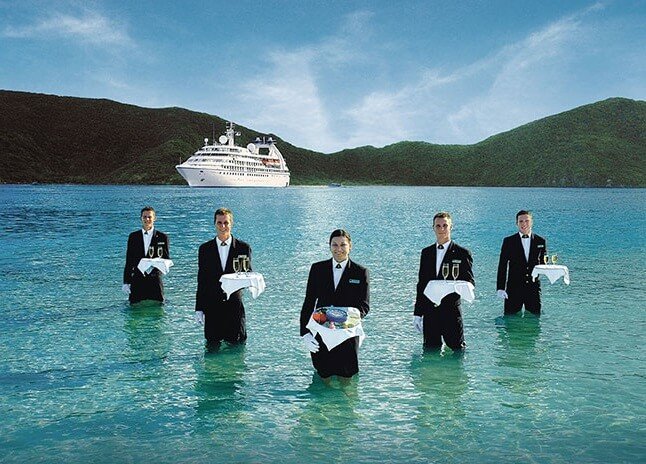

Getting us what we need shouldn’t be a problem. If you’re a candidate for any kind of transaction, you probably have an excellent in house or outsourced accounting staff, and you can furnish summary information quickly. Sometimes we do unusual and creative things to convey your value proposition to the market, and we’ll discuss that process. We operate under plain language agreements that don’t need heavy legal scrutiny. But keep in mind that if you haven’t paid us anything, we don’t owe you anything. We work hardest for the clients who work hard for us.

Working hard is great. Combine that with working smart and now you’ve got something. It’s a smart play for you to look at us as more of a partner and investor in you than just a vendor or contractor. Lopsided relationships never last long. Win-win relationships produce results and last a long time. Let’s rack up a win together!